5 ways to improve your sales process

Deadline Tracker • September 25, 2020

5 ways to improve the sales process

Cloud accounting software is everywhere and with Making Tax Digital set to increase its scope, now is undoubtedly the time to make that switch. Apart from a necessity of turning cloud based however, let’s also examine whether it can improve your existing processes.

We are big fans of Xero and hence our listed examples are based on the Xero product. That does not nonetheless mean that Xero is the only cloud accounting solution and there most definitely other alternatives solutions also out there.

1) Invoicing On-The-Go

With the use of the Xero app, invoices can be created, approved, emailed and accepted before you leave the client’s premises. All you need is your smart phone. No need to wait till the end of the month to send your invoices or spending time at the weekend doing the paperwork and resending missing invoices.

This made perfect sense for a company selling medicine equipment while visiting doctors or medical staff as they could create new customers on the go and coupled with the fixed item pricing could easily create the correct invoice using the correct pricing structure and ensure that it has been received while making the sale and not having to take all the details down and having to wait until finance has created the invoice before discovering any mistakes or missing information.

2) Pay now

By using cloud accounting software to produce and send your invoices and if you have the facility for customers to pay by debit or credit card through the likes of Stripe or PayPal, you can create a direct link embedded in the invoices to enable your customers to pay there and then simply use the ‘Pay Now’ button.

As the use of smartphones is more and more prevalent nowadays, this gives the customer the ability to pay your invoice no matter where they are or what they are doing and not have to wait until there are back in the office. Who doesn’t want to get paid quicker!

3) Quoting to invoice

How synced are your quoting and invoicing systems? By using the quoting system within Xero, you can produce quotes with the same look and feel as your other financial documentation. It also provides a simple CRM system as you can see what quotes have been accepted, rejected, need updating or chasing. And invoicing time comes, all you need to do is simply convert the quote into an invoice, ready for sending out.

But if you need more from a CRM / quoting system then there are plenty of Xero integrated add-ons to choose from, that will enable you to create the best solution for your business.

4) Repeating invoices

If your invoicing is for standard amounts at regular intervals, then invoicing can be done without you even having to think about it using repeating invoicing. By setting up the criteria you can either create invoicing in a draft format to be approved. Alternatively, if you don’t need to pre-approve it, you can just send the invoice and it will wing it’s way to your customer. Invoicing while you sleep.

For a network subscription company who had annual invoicing (but the renewal was based on joining date) invoicing became straightforward as the system would automatically produce the invoice, ready for approval. This meant invoicing was not relying on a manual spreadsheet and subscription renewal dates whilst also allowing the saving of time which could be put to better use.

5) Tracking on Projects

By using Xero projects in conjunction with Xero invoicing it is quick to see if you are on track with quotes and projects. You can produce reports to show which jobs are profitable once all allocated costs including time have been allocated to that particular project. This is a useful tool to see which type of work generates profit or of something has gone wrong it can be identified and resolved for future projects.

For a manufacturing and installation company this proved invaluable as previously though they had an understanding of time spent found it difficult to track additional costs such as travel and accommodation per project so didn’t have a true understanding of which projects were profitable or if there were additional costs that could be recharged.

We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements.

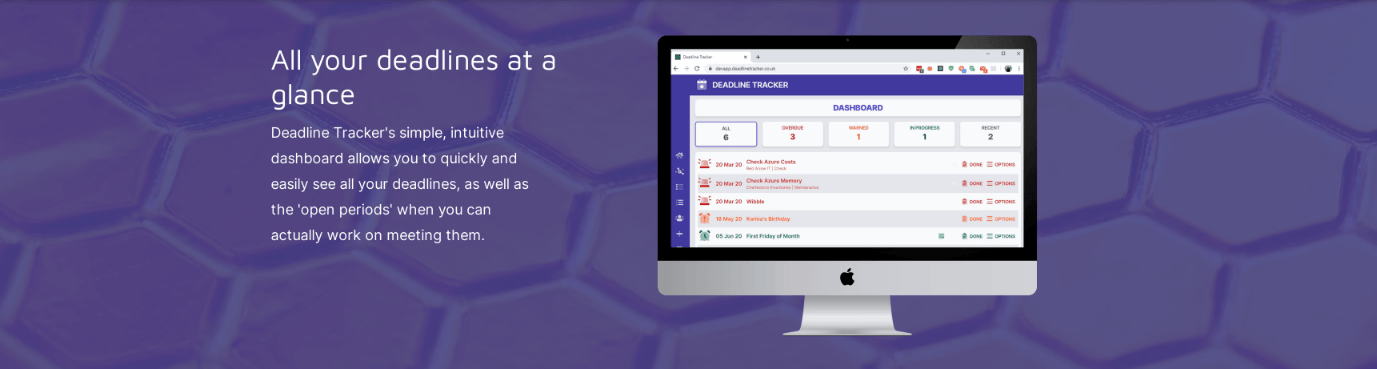

Deadline Tracker is here to simplify your deadline tracking and enable you to make better use of your time, focusing on your customers. Take advantage of our 30-Day FREE Trial option to experience the power of Deadline Tracker. Eliminate the confusion, inflexibility and inefficiencies associated with your existing 2 or 3 product deadline tracking solution by signing up to Deadline Tracker for free now.

We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements Keep up to date with the latest content by following our Social profiles on Facebook, LinkedIn, and Instagram.

Automation and cloud-based technology is allowing accountancy firms to move to the next level in providing maximum value for their clients. Giving value to your customers is a winner for both. For instance, if you can advise clients on maximising their turnover from £150k to £200k, everyone benefits with increased fees and profits. Having a conversation is important There’s an old bit of business advice that says don’t send an email when you can make a phone call and don’t make a call when you can meet. Reach out to your clients and talk to them. Before that, make sure you check on what is going on with their business, as they will expect that. It doesn’t have to be bad news or reminders about taxes and deadlines, it can be a discussion on how well they are doing. Outsourcing can help you keep track of your business and deliver more for clients. Accountants possess a wealth of data which is not always being used in the client’s best interest if they are bogged down with paperwork. It’s a lost opportunity to be proactive with them. Business can be generated by offering good value This is where Deadline Tracker comes into the picture. We all hear about how the labour shortage has hit accountancy hard and firms cannot get the right staff. Deadline Tracker is a dedicated tailor-made solution that can relieve the pressure on deadlines. Get it wrong or miss the filing deadline and you could incur penalties, which will increase if you delay in correcting the situation. That is where outsourcing can break a logjam. Deadline Tracker allows you to do away with complex spreadsheets and stop your calendar from being overwhelmed with customisable alerts, easy filtering of tasks, and an intuitive, single dashboard setup. Added value that frees up time and eases deadline pressure. All of this allows accountants to concentrate on delivering value for money, which needs to be demonstrated as unhappy clients can vote with their feet and look elsewhere for better value. We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements Keep up to date with the latest content by following our Social profiles on Facebook and LinkedIn .

Research from employment specialists Reed has found that half of UK workers are prepared to leave their roles to access hybrid working benefits. This means firms must now more than ever, double down on their employee retention efforts, especially accountants who have been hit badly by staff shortages. So they must showcase what they have to offer. Whether it be career progression, alternative career pathways providing a new challenge, learning and development or establishing greater flexibility around how and where people will work in a post-pandemic world. What is employee onboarding? Onboarding new staff is the process companies go through to welcome and integrate them into the workplace, a process that extends far beyond the first day, but continues until they’ve fully adjusted to their role and team. It allows for getting acquainted with the company culture and feeling welcomed and valued in their team. Why is onboarding important? If initial training and communication is poor, it can lead to demotivation. This may be one of the reasons that up to 25 per cent of new employees leave their jobs after their first three months. And this is a huge loss for a company that must repeat a costly hiring process to find a replacement. Good onboarding means staff reach full productivity faster, so getting new employees up to speed effectively can improve your company’s employee retention. As can outsourcing parts of the accountancy process to allow these employees to flourish. Onboarding process steps When welcoming new staff on board there are measures, like sending them a company welcome package, arranging a team lunch or dinner with colleagues, or preparing a presentation, that will make them feel welcome. Put together a plan for their first few days on the job and check all the important boxes, like informing co-workers, setting up their workstation or informing the front desk staff about the new arrival. So outsourcing tasks like tracking deadlines can help and allow accountants to concentrate on their staff. The chances are that new talented members of staff will stay and flourish if certain tasks can be outsourced. Organise deadlines and save time Deadline Tracker allows you to do away with complex spreadsheets and stop your calendar from being overwhelmed with customisable alerts, easy filtering of tasks, and intuitive, single dashboard setup. It can automatically manage deadlines and workflow by showing tasks in the order of priority that they should be worked on (overdue, warned, in progress and upcoming) in a kind of traffic light system. It allows you to organise, prioritise and track all of your deadlines in a single, easy-to-use system. All of this allows accountants to concentrate on attracting and utilising top talent. We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements. Keep up to date with the latest content by following our social profiles on Facebook , LinkedIn , and Instagram .

There are many jokes about missing deadlines. Here’s one: “I'm reading a book about meeting deadlines – I should have finished it a week ago.” How about this: “Why did the chef miss his deadline? – He ran out of thyme.” Amusing, yes, but for businesses and their accountants, missing deadlines is not a joking matter. The explosion of technology and digital data puts many challenges in the path of SMEs. Deadlines are a part of every accountant's job, but with accountancy evolving more into advisory roles, many traditional tasks are now being outsourced. Outsourcing can also help with hitting those all-important deadlines with tasks like tax filing deadlines, quarterly and annual financial report deadlines, and deadlines imposed by clients who need financial information by a set time. Bespoke deadline tracking technology can help prevent accountants from tearing their hair out by helping to manage their workload. It can also help as businesses strive to attract the talent needed for an evolving profession. A move to address this has been launched by the global body for professional accountants ACCA (the Association of Chartered Certified Accountants) and the International Baccalaureate organisation (IB). They have signed a Memorandum of Understanding (MOU) that creates a pathway programme for IB students towards a professional accountancy career. ACCA’s diploma covers a wide variety of business and finance subjects, including technology and digitalisation, alongside core financial and management accounting subjects. Accelerated pathway into accountancy The IB is a non-profit foundation that offers four educational programmes for students. In the UK, it is studied mainly by young people in years 12 and 13 as an alternative to A levels. Accountants will benefit from this new talent ready gradually coming on stream and stepping up to the plate as the profession moves forward to a more advisory and consultative role. That does not mean that traditional tasks like compliance are overlooked and that’s where deadlines become ever more critical, and automation of tasks plays a clear role in improving efficiency. Keeping pace with fast-moving environments and supplying solutions to hitting deadlines and improved efficiency are outsourcing experts who can unburden businesses of some of the more mundane tasks with the use of clever interactive technology. Deadline Tracker is pretty much a unique development in the market, automatically managing your deadlines and workflow by showing tasks in the order of priority that they should be worked on (overdue, warned, in progress and upcoming) in a kind of traffic light system. It allows you to quickly and easily see when you can actually work on a deadline and not just focus on the due date. Deadlines will never creep up on you again. No joke! We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements. Keep up to date with the latest content by following our social profiles on Facebook , LinkedIn , and Instagram .

Ticking away the moments that make up a dull day, Fritter and waste the hours in an offhand way, Kicking around on a piece of ground in your hometown, Waiting for someone or something to show you the way When Pink Floyd recorded those lines in the song ‘Time’ on their classic Dark Side of the Moon album, they were making a point about procrastination rather than taking action and the final line makes it clear you are sometimes waiting for expert help. A missed deadline is costly in terms of incurring penalties and losing business with the added impact on your reputation. Missing filing annual reports on time on behalf of corporate clients, or tax returns for individual firms can be costly for both sides. Accountants are busy people juggling various accounts and losing track of deadlines can easily happen as the pressure builds. The days of keeping track of such areas with pen and paper have pretty much been consigned to the scrapheap, no doubt with a few exceptions, like firms still using: · An annual calendar on the wall with highlights on deadline dates · A drawn timeline on a roll of paper · Information drawn an annual wheel · An actual physical diary As the festive season is upon us, we wish everyone a Merry Christmas and Happy New Year and hope you will be able to celebrate with your family this year. In that spirit, maybe time to treat yourself by allowing your firm to outsource these key tasks to an expert like Deadline Tracker. A variety of businesses use these electronic tools to highlight key dates, facilitate day-to-day operations and keep track of plans for meetings or projects. Deadline Tracker is a dedicated tracking app that allows you to organise, prioritise and track all of your deadlines in a single system, offering customisable alerts, easy filtering of tasks, and an intuitive, single dashboard setup. Our smart, intuitive dashboard allows you to create customisable alerts, and filter tasks as well as assign them to the relevant team member. In other words, it saves you precious time and then money. Pink Floyd no doubt would have approved. We’d love to hear your view so do not hesitate to contact us, subscribe to our powerful software for free, or simply choose one of the paid packages, according to your requirements. Keep up to date with the latest content by following our social profiles on Facebook , LinkedIn , and Instagram .